Credit Risk Management Resources

Our resource hub contains our latest articles, news, events, videos and support materials on all things related to credit risk management.

Credit Risk Insights From The ATO Corporate Plan 2025-26

The Australian Taxation Office (ATO) has released their corporate plan for 2025-26. The plan covers the periods of 2025-26 to 2028-29 and sets out how the ATO will meet their commitments. Our article covers the key activities and priority areas that relate to B2B credit management including strengthened debt collection.

View Article

Director Penalty Notices: What’s The Impact For Creditors

One of the collection tools used by the Australian Taxation Office (ATO) is to issue a Director Penalty Notice (DPN). The goal is to recover overdue business tax debt personally from current or former company directors. Once a non-lockdown DPN is issued, a director has 21 days to act before they become personally liable. Options typically are to pay the debt or appoint an insolvency or restructuring practitioner. This short timeframe often leads to insolvencies or small business restructuring seemingly coming ‘out of the blue’ to creditors. In this article we cover what a DPN is, ATO DPN rates, what does a DPN mean for creditors and risk management strategies (including accessing vital ATO business tax default data).

View Article

Key stats for creditors: ASIC’s ‘Review of small business restructuring process: 2022–24’

The Australian Securities & Investments Commission (ASIC) have released their ‘Review of small business restructuring process: 2022–24’. The review was designed to examine this insolvency regime to see if it is delivering on its objective to reduce the complexity and costs involved in insolvency processes to help small businesses to survive. Here Access Intell summarises the key statistics relevant to creditors.

View Article

How PPSR Protects Creditors From Unfair Preference Claims (Preferential Payments)

A customer going into liquidation is devastating, but an additional concern for creditors is an unfair preference claim. You’ve done a great job collecting money owed, but now the liquidator is looking to claw that money back. Using the PPSR wisely can provide a powerful defence. This article explains what a preferential payment is, how PPSR can protect your business from an unfair preference claim and best practices for creditors.

View Article

A Creditors Guide To Small Business Restructuring

Small Business Restructuring (SBR) is a lower-cost, faster insolvency option designed to help companies survive financial difficulties. They are increasing exponentially and are expected to continue to grow, now sitting at 22% of all corporate insolvencies. SBR presents unique challenges for creditors. Our guide covers what this process is, how the ATO relates, what it means for creditors and how it affects PPSR.

View Article

Key PPSR learnings for credit managers from the AFSA ‘State of Personal Property Securities System’ report

The Australian Financial Security Authority (AFSA) recently released its ‘State of Personal Property Securities System’ Report for 2023-24. The report focuses on the current state of the PPSR, regulatory priorities, and future directions. The report underscores the PPSR's critical role in supporting Australia's $3.6 trillion credit system by enabling creditors to protect security interests and empowering informed decision making. The PPSR holds registrations with a potential economic value of $450 billion, which is approximately 20% of Australian GDP*. Access Intell has distilled the report into key learnings for credit managers. Read on to learn how the PPSR is performing, market trends, AFSA’s future focus, and the importance of registering.

View Article

A credit management guide to ATO Disclosure of Business Debts tax information

The Australian Taxation Office (ATO) Disclosure of Business Debts legislation provides tax default information that is vital to assessing creditworthiness. In this article Access Intell explains what tax default information is, why it’s important to know when extending trade credit, how director penalty notices (DPNs) relate, and where to access this information to proactively manage your business’s financial risk. With over 36,000 business tax debts disclosed in the 2023-24 financial year, businesses can’t afford to miss this critical information.

View Article

Trends in Credit and Accounts Receivable Technology for 2025: Part 2

With insolvency levels as they are, PPSR Processing and Risk Monitoring are topics regularly on the credit agenda. In this, Part 2 of our Trends in Credit and AR Technology, Lynne Walton examines how workflow automation, data integration and connectivity are improving speed and efficiency and reducing risk and cost in top performing trade credit management processes.

View Article

Credit risk management insights from the ATO annual report

The Australian Taxation Office (ATO) recently released their latest annual report. Access Intell has distilled all 328 pages into insights specific to credit risk management. Read on to learn how the ATO’s activities (including their return to business-as-usual debt collection and the adoption of a firmer posture towards debt repayment) has and will continue to impact credit risk management.

View Article

Access Intell becomes Divisional Partner of the Australian Institute of Credit Management

Access Intell is pleased to continue our support of the Australian Institute of Credit Management (AICM) by becoming a Partner for the Queensland Division. This sponsorship is part of our ongoing commitment to supporting and advancing innovative credit management.

View Article.avif)

Data enhancements via our latest partner Coface

Coface is a leading global expert in credit information services. We’re pleased to offer Coface credit reports and monitoring within the Access Intell platform. It's yet another addition in our quest for new global data partners, innovative data sources, and third-party integrations.

View Article

Trends in Credit and Accounts Receivable Technology for 2025: Part 1

Artificial Intelligence (AI) is on every Business Leader’s radar as we leave 2024 behind but process workflow, data interrogation and connectivity are the topics taking centre stage. Access Intell works with businesses of every size, in every industry sector, and with every problem, limitation or restriction possible across its portfolio of clients. They are well placed to see what’s happening in detail across the industry. Not surprisingly, Access Intell CEO and Founder Lynne Walton sees ‘best in class’ credit and finance teams implementing highly connective, integrated solutions that place data access, information flow and interpretation front and centre in their quest to perfect internal processes and controls. In this article series, Lynne will explore some of the modular components she sees most often and examine some of the reasoning behind their introduction. Part 1 of 3 examines the first stage – customer onboarding – where innovation is having a real impact on productivity.

View Article

Using data visualisation for effective credit risk management

What is data visualisation and how does it relate to credit management? Access Intell shares the benefits of data visualisation for credit risk assessment, management and analysis, and how we use it to deliver value to credit and accounts receivable teams.

View Article

Your Options When You Miss A PPSR Renewal

Users of our Access PPSR software never miss a PPSR renewal - but for those who don't, what are the options when a renewal has been missed? We share three general options, provided for informational purposes only, and which only applies to the supply of goods on credit subject to retention of title terms.

View Article.avif)

Are you adapting your credit decisioning models to maximise accuracy?

Predicting outcomes can never be perfect but, to maintain a high level of accuracy in this unstable, fast moving world, change is really the only constant. Incorporating that change into credit decisioning models in real time is the key to optimising business performance and avoiding failing customers and those least likely to pay within terms.

View Article

What Is PPSR & Why Do Financiers Need To Understand It?

As a financial institution, protecting your assets and reducing losses is a top priority. One essential tool to achieve this is understanding the Personal Property Securities Register (PPSR). In this article, we’ll explain what PPSR is, its importance, and how it can help your institution safeguard its interests.

View Article

Access Intell approved to receive Australian Taxation Office default data

Access Intell is pleased to announce it has become the latest business approved by the Australian Taxation Office under the Disclosure of Business Debts legislation to receive tax default information. This means clients that use its online trade application and credit risk monitoring platforms will have instant access to this vital creditworthiness information.

View Article

PPSR Toolbox for ‘out of the ordinary’ situations

Navigate through the practicalities of a few not so commonly faced PPSR situations whilst maintaining enforceable security.

View Article

Top Strategies For Mitigating Risk In Financial Institutions

Whether you’re an established business or a startup, risk mitigation is a constant concern. Risk-taking is a fundamental aspect of banking, so it’s no surprise that banks have always practised risk management – it’s essential for their survival. After all, risks have been inherent in the banking system ever since the first Sumerian merchants borrowed barley from a temple thousands of years ago. Without credit risk management in banks, the industry wouldn’t have lasted as long. The main shift over time has been the need for more advanced strategies for credit risk management in the 21st century. As the popular saying goes, ‘Modern problems require modern solutions.’ Credit risk management is a significant part of a financial institution’s overall risk management strategy. However, risk mitigations aren’t just about preparing for financial downturns. It’s an ongoing process. Effective risk mitigation strategies encompass all business facets, from operations to human resources.

View Article

Factors To Consider When Evaluating A Borrower’s Creditworthiness

Loans play a vital role in any economy. It can act as an economic stimulus by allowing transfer of money between lenders and borrowers, which enables businesses to invest, expand, and generate employment. Furthermore, loans are a major source of revenue for banks. While lending is a vital aspect of banking, financial institutions also bear the responsibility of mitigating potential risks. Therefore, they need to check the creditworthiness of the borrower. For financial institutions, it’s part of having good credit risk management.

View Article

How To Protect Your Business From Customer Insolvency Through Effective Credit Risk Management

In an increasingly competitive and uncertain economic climate, businesses must be vigilant in managing credit risk associated with their customers. Effective credit risk management is essential to protect a company from the detrimental effects of customer insolvency, which can lead to significant financial losses and negatively impact cash flow. This article aims to discuss in-depth strategies and tools businesses can implement to minimise credit risk, mitigate potential consequences of customer insolvency, and ultimately safeguard their financial stability.

View Article

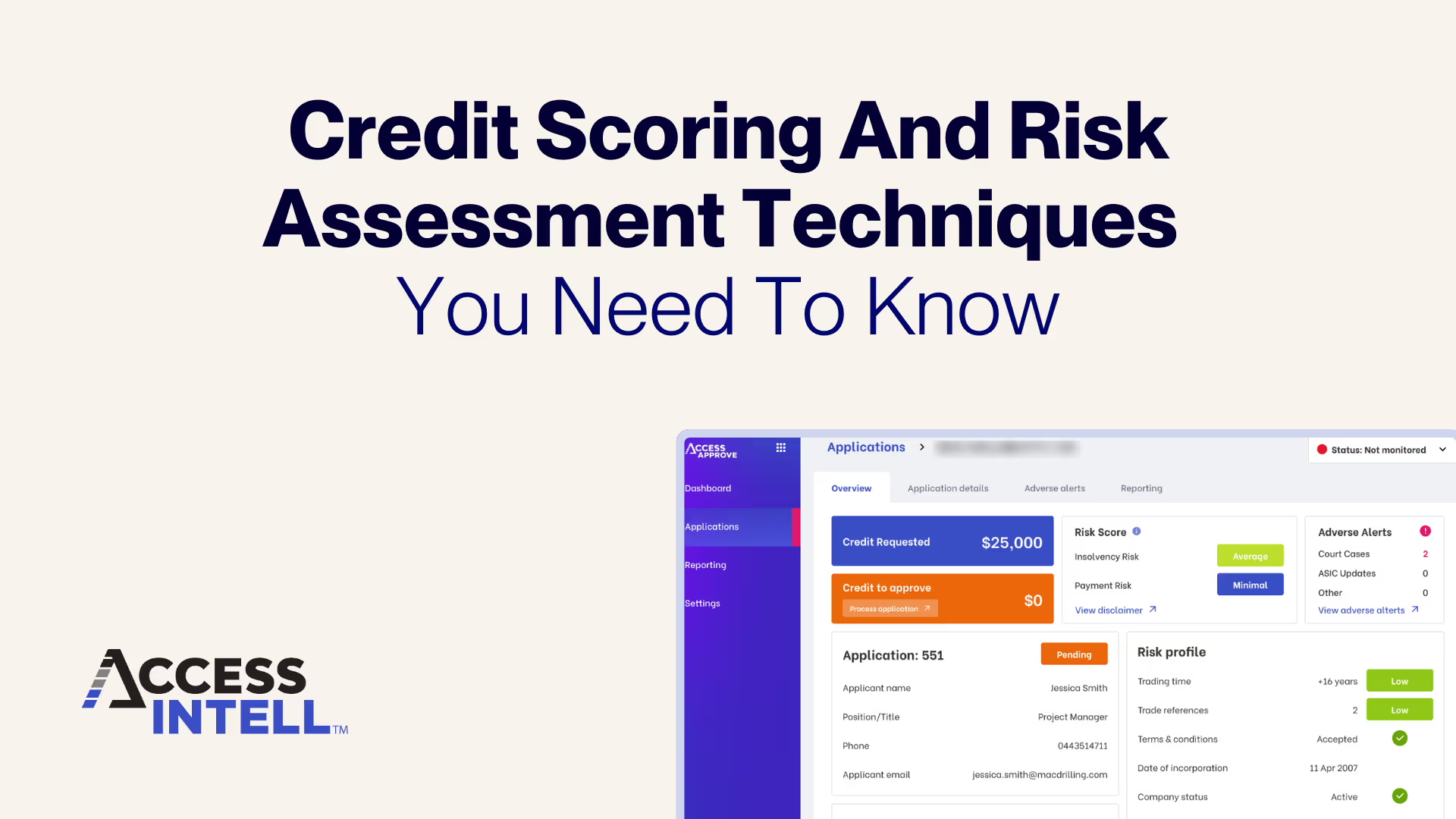

Credit Scoring And Risk Assessment Techniques You Need To Know

Credit risk management is a cornerstone of any financial institution’s operation. Central to this task are two key techniques: credit scoring and risk assessment. A blend of data analysis, financial intuition, and predictive modelling, these methods help banks decide who to lend to, how much, and under what terms. But what exactly are these techniques? And how are they applied in the real world?

View Article

How to successfully use PPSR to get paid

Lynne Walton from Access Intell helps us better understand our PPSR rights to help us achieve an improved outcome.

View ArticleOnline Trade Credit Application Speeds Up Customer Onboarding From Days To Hours

“Their Approve product gives us an organised paperless process which brings together everything we need in one place. It has helped us speed up the time taken to approve applications pleasing customers, our sales team and our finance team.”

View Case StudyReliance on outdated credit data lost this business $25,000

“With so many disparate data sources, it’s easy for businesses to miss important information that impacts creditworthiness. Our bureau-agnostic solution gives clients the full risk picture, instantly.”

View Case StudyExpired PPSR registration leads to catastrophic $3 million financial loss

“It’s always devastating to see businesses suffer catastrophic losses such as these, especially when such a low-cost, effective solution exists.”

View Case StudySuccessful PPSA Retention of Title claim against customer in liquidation

“Faced with the prospect of fighting a substantial unfair preference claim, while holding a PPSR, we worked with Access Intell to ‘negotiate’ a more commercial outcome. Lynne’s commercial approach helped us avoid a protracted legal battle and gave us the results we wanted.”

View Case StudyWhy Online Credit Application Software Is Great For Salespeople

Credit and sales team conflict is common - but doesn’t have to be. In an ideal world, both teams understand each other’s challenges and work together to find a wise way forward to approve more accounts. Learn how online credit application software like Access Approve can improve internal relationships and meet the needs of your sales team.

View Use CaseHow hospitality suppliers easily and continuously validate liquor licenses

Do you supply alcohol to the hospitality industry, including cafes, restaurants, pubs, clubs and bars? Validating your customers liquor licenses is crucial for regulatory compliance and credit risk management. The Access Intell risk management platform can easily automate this task.

View Use CaseManage credit risk by validating building licenses automatically

Are you a trade supplier to the building and construction industry? Validating your customers building licenses is crucial for credit risk management.

View Use CaseUsing risk assessment to prioritise accounts receivable collections

There are many ways accounts receivable teams can prioritise their collections for efficiency and optimum cashflow. Prioritising by risk assessment is another targeted strategy option. Access Monitor does the risk assessment for you, placing your customers into risk bucket categories. You can quickly and easily see where your risk lies and take action.

View Use CaseGroup your customers to instantly view risk the way you need it

Each business has its own unique structure, risk profile and customer base. Keeping track of changes to your customers and where your risk lies can be time consuming. Our customer grouping feature gives you the ability to quickly and easily group your customers to view risk the way it works for you.

View Use CaseA faster, easier way to update terms and conditions of trade with your customers

Do you have updated terms and conditions of trade to issue to your customers? Need to quickly and easily collect digital signatures? Access Approve can automate this administrative task, saving time and ensuring your business is protected for both future trade and effective PPSR enforcement.

View Use CaseStreamline the creditworthiness assessment of customers

Do you already have your own paper or digital new customer onboarding process, but want to make the process of assessing their creditworthiness easier? Access Approve is the answer.

View Use Case

AICM National Conference 2025

See us at the 2025 AICM National Conference this October on the Gold Coast.

View Event

RMA Network Annual Conference 2025

Ashlee will be sharing our PPSR expertise specific to agribusiness as a guest speaker.

View Event.avif)

Access Intell Webinar: Coface Credit Reports

Join the Access Intell team, along with Coface's Benny Kesuma, for a 30-minute webinar to delve into the Coface credit reports now available in our platform.

View Event

Access Intell & BICB State of Credit Risk Breakfast

Access Intell and BICB are hosting a must-attend event for credit professionals in the building and construction industry.

View Event

Something Tech 2024

We're thrilled to be exhibiting at Something Tech, Australia's digital, innovation and technology festival.

View Event

Forward Fest 2024

We're thrilled to be showcasing at Forward Fest 24, a dynamic and engaging business festival of ideas, creativity, and technology on the Sunshine Coast.

View Event

Small Business Restructure - The Implications You May Not Know

Access Intell Founder and CEO Lynne Walton joins the Financial FOFU podcast to talk about Small Business Restructuring.

View Video

Understanding PPSR With Lynne Walton

Founder and CEO of Access Intell Lynne Walton talked all things PPSR recently on the Financial FOFU podcast.

View Video

How The Access Intell Products Work

How Access Intell transforms diverse global data to credit risk intelligence in three steps.

View Video