Financial Services

Effective Credit Risk Management Solutions for Financial Services Companies

Leading-edge PPSR, commercial motor vehicle searches and credit risk management solutions for financial services providers such as banks, finance companies and other lenders. Onboard creditworthy customers, register security on PPSR and monitor for risk.

Make wise credit decisions, manage financial risk, and get paid

Financiers well know that the consequences of an incorrect PPSR are severe: no security and a total loss. As a leading authority on PPSA and PPSR matters for 14 years, Lynne Walton has established Access Intell as one of very few service providers occupying the niche space between the PPSA law and the operation of the PPSR register.

Before Access Intell

After Access Intell

Automated, Accurate Registrations

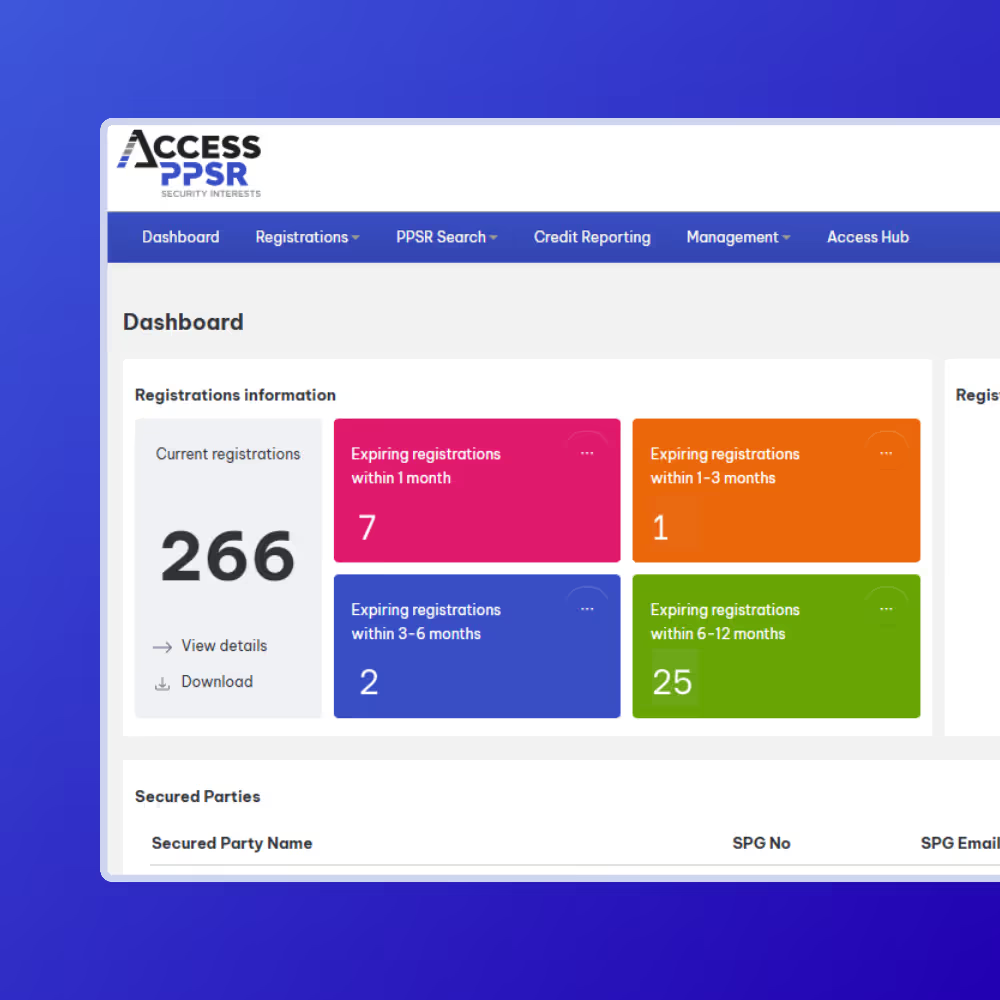

Access PPSR is our automated PPSR registration processing and management product that offers financiers an easy, effective PPSR solution. Pre-set profiles and built-in grantor and asset validation tools ensure registrations are right every time. Access PPSR can sit alongside and complement existing systems without interfering with them to enable effortless compliance monitoring and early detection of errors.

Lynne and the Access Intell team have conducted PPSR compliance projects for first and second tier Australian banks - one carrying over a million registrations in its asset finance portfolio - and major asset backed lenders. A healthy PPSR profile for an asset backed lender is 97% compliance. How would yours compare?

Commercial Motor Vehicle Searches

Quickly and easily order the motor vehicle searches you need, when you need. Save time by completing all your commercial searches in one place, with aggregated data from NEVDIS, PPSR and RedBook.

View our commercial motor vehicle search options.

Ongoing customer risk monitoring

Access Monitor enables financiers to continuously monitor the credit risk of their customers. Instantly see customer changes and risks to your lending, with all the information you need to proactively make decisions in one place.

We’ll have you onboarded within 24 hours. Our flexible software integrates seamlessly with your unique business structure, processes and needs.

Our leading-edge products

The Access Intell products create a streamlined credit risk management process from online trade applications and PPSR through to ongoing risk monitoring. Visit our product pages to learn more about their features and view interactive demo's.

Seamless Onboarding For You and Your Customers

Access Approve gives you (and your customers) an efficient, paperless onboarding process. Receive, assess and approve trade credit applications online, seamlessly.

Protect your business with easy, accurate PPSR

Access PPSR simplifies the complexity of registrations through automation for an efficient, accurate process. In the event of customer insolvency, you're a secured creditor and are first in line for payment.

Proactively manage risk with your choice of intelligence

Access Monitor enables you to continuously monitor the credit risk of your customers. All the information you need to proactively make decisions and manage credit is in one place, saving you time.

.avif)

Case Studies

Learn how financial services businesses like yours are using our products to make wise decisions and grow sales.

Online Trade Credit Application Speeds Up Customer Onboarding From Days To Hours

Reliance on outdated credit data lost this business $25,000

Expired PPSR registration leads to catastrophic $3 million financial loss

Successful PPSA Retention of Title claim against customer in liquidation

Client testimonials

Our clients say we go above and beyond – hear what they have to say.

Scott Harrison

Financial Controller, NGP

Natalie Webber

National Credit Manager, Volvo Group Australia

Matthew Rouse

Managing Partner Rouse Lawyers

Ready to make wise decisions?

Book a meeting with us to have a personalised discussion on how we can add value to your business.