CFO's

Effective Credit Risk Management Solutions for CFO's

Leading-edge credit risk management solutions for Chief Financial Officer's to create productive credit teams that support smarter business growth. Onboard creditworthy customers, register security on PPSR and monitor for risk.

Make wise credit decisions, manage financial risk, and get paid

High-performing credit teams use our leading-edge products to manage risk throughout the customer life cycle. The top features for CFO's include automation of manual processes, accurate PPSR registrations, and customisable risk profiles.

Before Access Intell

After Access Intell

Improved productivity of your credit team

Save time and money by efficiently automating manual processes. Focus your credit team on value-adding tasks whilst being confident your team is doing their due diligence.

Accurate, efficient PPSR registrations

Ensure your team protect the business against financial loss and insolvent customers with accurate and efficient PPSR registrations. One-click registrations are right every time with our pre-set profiles and built-in validation tools. Minimise writing off bad debt and improve your balance sheet.

Smarter business growth

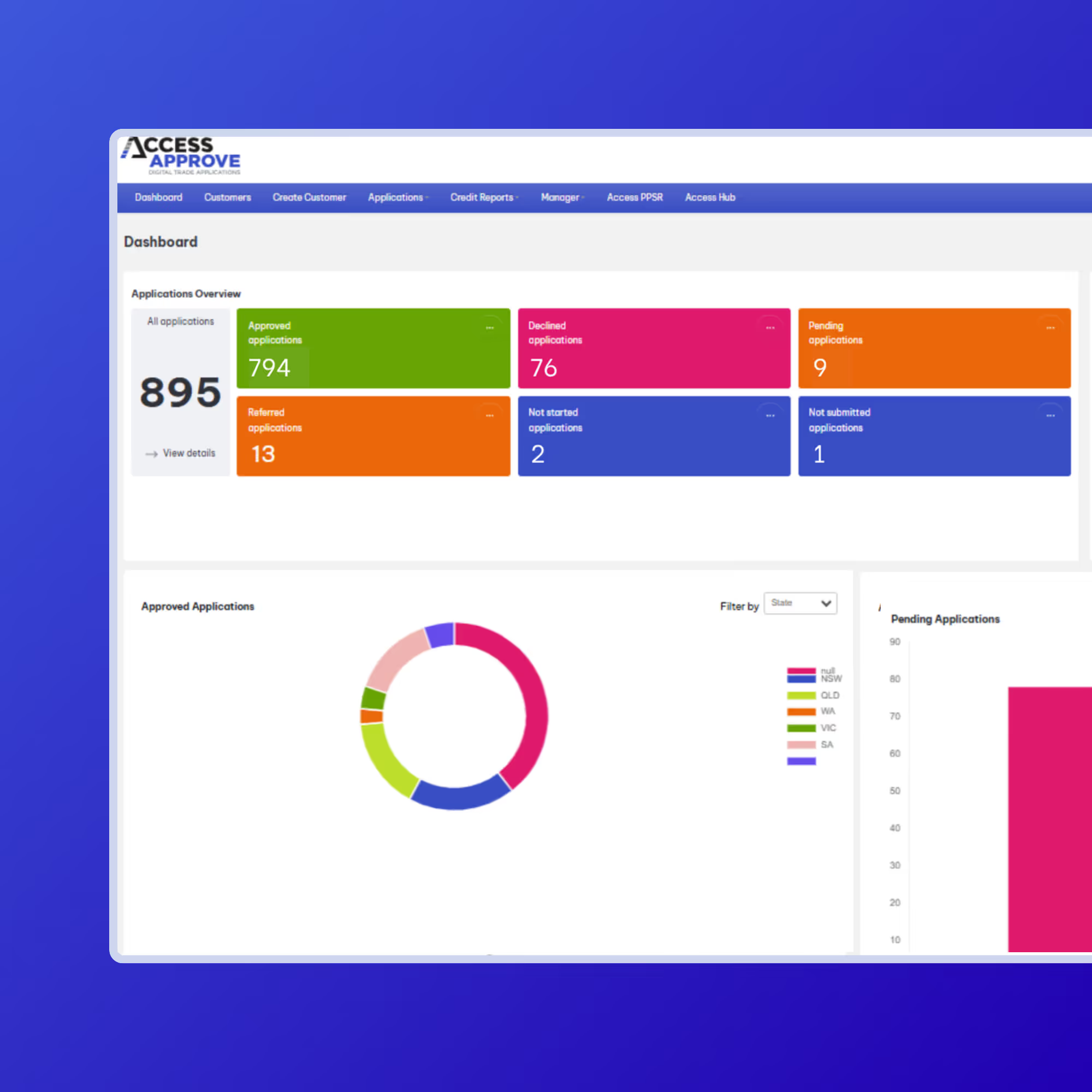

Ensure your team is enabling business growth in line with your unique risk profile. Access Approve offers online trade applications with automated data prefill, instantaneous risk ratings and approval workflows.

We’ll have you onboarded within 24 hours. Our flexible software integrates seamlessly with your unique business structure, processes and needs.

Our leading-edge products

The Access Intell products create a streamlined credit risk management process from online trade applications and PPSR through to ongoing risk monitoring. Visit our product pages to learn more about their features and view interactive demo's.

Seamless Onboarding For You and Your Customers

Access Approve gives you (and your customers) an efficient, paperless onboarding process. Receive, assess and approve trade credit applications online, seamlessly.

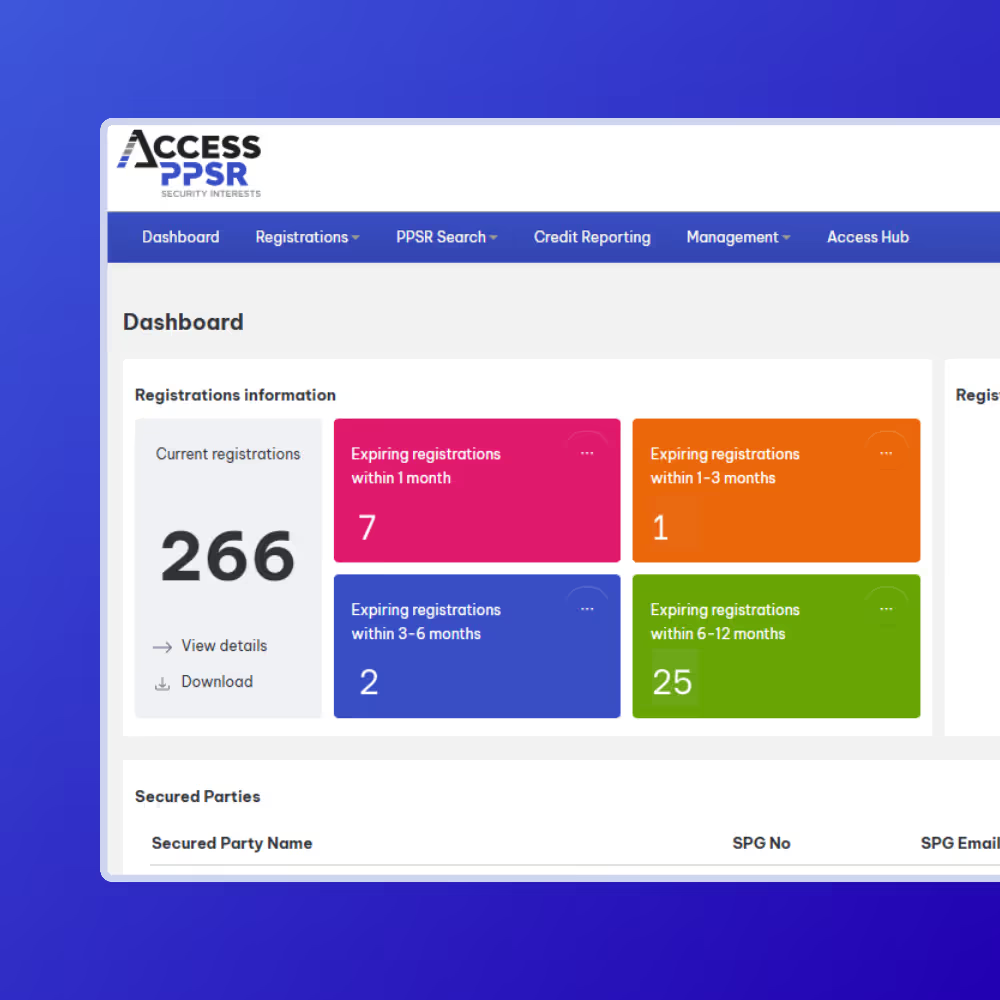

Protect your business with easy, accurate PPSR

Access PPSR simplifies the complexity of registrations through automation for an efficient, accurate process. In the event of customer insolvency, you're a secured creditor and are first in line for payment.

Proactively manage risk with your choice of intelligence

Access Monitor enables you to continuously monitor the credit risk of your customers. All the information you need to proactively make decisions and manage credit is in one place, saving you time.

.avif)

Case Studies

Learn how businesses are using our products to make wise decisions and grow sales.

Online Trade Credit Application Speeds Up Customer Onboarding From Days To Hours

Reliance on outdated credit data lost this business $25,000

Expired PPSR registration leads to catastrophic $3 million financial loss

Successful PPSA Retention of Title claim against customer in liquidation

Client testimonials

Our clients say we go above and beyond – hear what they have to say.

Scott Harrison

Financial Controller, NGP

Leon Dodd

General Manager

Aron Narayan

Financial Controller, Hurford Wholesale

Ready to make wise decisions?

Book a meeting with us to have a personalised discussion on how we can add value to your business.